"Choosing the Right Business Bank Account: A Step-by-Step Guide" Fundamentals Explained

Every small service owner recognizes that maintaining keep track of of funds is an necessary component of functioning a effective business. Nonetheless, one element that is often disregarded is the usefulness of having a different bank profile for your business. In this post, we are going to talk about why every little business need to have a separate financial institution profile and the perks it supplies.

1. Splitting up of Personal and Business Expenditures

One of the main explanations why every small business require a distinct bank profile is to maintain personal and company expenses distinct. When you commix your private and organization expenses, it becomes difficult to determine which expenditures are for personal make use of and which are for your service. This can lead to confusion when it happens time to file income taxes or track your finances.

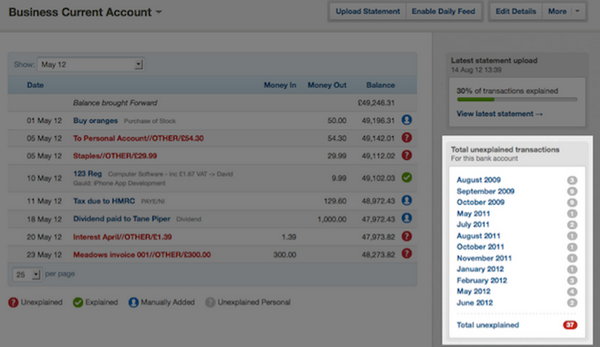

Having a distinct bank profile assists you keep keep track of of all your company deals in one spot. You may effortlessly check all inbound income and outgoing expenditures related to your business, creating it less complicated to examine monetary reports and create informed decisions regarding the future of your business.

2. Improved Record Keeping

Maintaining exact records is critical for any sort of little business proprietor. With a dedicated bank account, you can easily conveniently maintain monitor of all financial transactions related to your provider in one place.

This permits you to quickly identify any kind of inconsistencies in your documents or discover deceptive activity before it becomes as well overdue. Additionally, having excellent record-keeping methods creates filing taxes much easier since all necessary info will be readily on call.

3. Professionalism

Separating private and business funds additionally helps keep professionalism along with clients, sellers, and various other services companions that might need to pay or receive repayments coming from you.

When carrying out ZilBank.com by means of a dedicated financial institution account especially for the business label, clients are extra likely to see you as genuine and specialist since they are doing deals with an company instead than an personal individual.

4. Easy Access To Financing

Little businesses typically call for paying for at some factor in their development adventure – whether it's taking out finances or using for credit history memory cards – producing a dedicated financial institution account can easily assist make the procedure considerably smoother.

Possessing a different bank account for your service assists you establish a credit rating record and enhances your chances of being authorized for car loans or other forms of money management. Creditors prefer services with distinct accounts because it reveals that the organization manager has taken the opportunity to set up proper profile methods and is significant concerning their service.

5. Conformity

Yet another main reason why every small business needs a distinct bank profile is to make sure compliance along with tax regulations and guidelines. Mixing individual and service finances can easily cause concerns in the course of an review or if any legal concerns emerge in the future.

Keeping your financial resources different produces it easier to conform with income tax laws, regulatory criteria, and other lawful commitments that come along with functioning a small company.

In conclusion, having a dedicated financial institution account for your little company delivers a lot of perks – coming from enhancing record-keeping to raising expertise along with clients. It likewise helps you maintain monitor of all economic purchases related to your company in one place, creating it easier to evaluate economic documents and make informed selections about the future of your company. Therefore if you haven't currently carried out thus, think about opening a distinct financial institution account for your tiny company today!